A Chase business credit card is a great tool to help you manage your business expenses. The application process may seem overwhelming. This article How To Apply For A Chase Business Credit Card will walk you through each step and answer common questions so that you can get your card.

I suggest exploring alternative options as well. Consider reviewing top credit cards for small businesses apart from the Chase Business card by reading the article Which credit card is best for small business?

Documents Required To Apply for Chase Business Cards

Gather the required documents before you start:

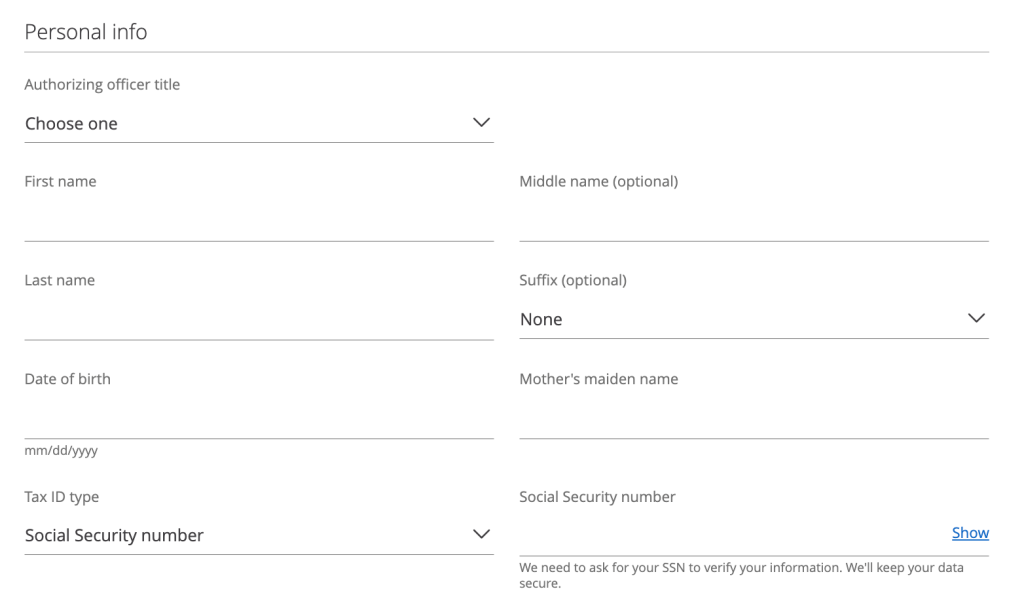

- Personal information: name, address, Social Security Number, date of Birth, contact details.

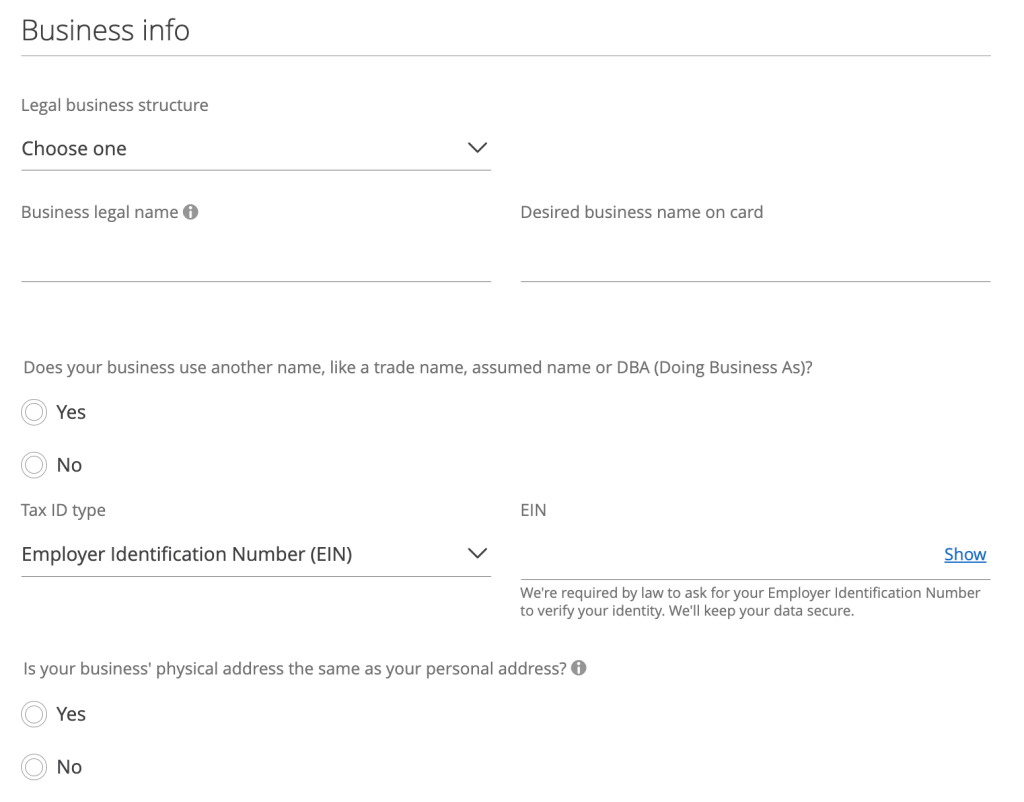

- Business information: legal business name, business type, estimated revenue per year, number of employees, employer identification number (EIN).

- Financial Information: Personal and/or Business Tax Returns, as well as business bank statements.

Depending on your card and business structure, you may need to provide additional documents.

How to Apply for a Chase Business Credit Card

Three main methods of application are available:

- Online: Visit the Chase business credit card website (https://creditcards.chase.com/ink-business-credit-cards/customers) and choose the card that best suits your needs. The application is simple and takes only 10-15 minutes.

- Chase Customer Service at 1-800-453 9779 will walk you through the process.

- Branch: You can visit a Chase branch to speak with a banker about the application.

Step-by-Step Guide:

1. Please enter your personal information: Name, address, Social Security Number, date of Birth, and contact details.

2. Enter your business information: Please enter the following: Your business name, address (if applicable), website (if applicable), EIN, type of business, estimated annual revenue, and number of employees.

3. Enter employee information (optional) if you wish to add cards for your employees.

4. Select Your Billing Statement Preferences: You can choose how you would like to receive your monthly statement (e.g. paperless billing or email notification).

You can submit your application for processing after carefully reviewing it.

Who can apply for a Chase Business Credit Card?

Chase Business Credit Cards are available to most businesses, including sole proprietorships and partnerships. Corporations and LLCs can also apply. The card may have different requirements.

These are some general eligibility requirements:

- Be a legally recognized business entity in the United States.

- A good credit score is important (typically, 670 or more).

- If applicable, meet the minimum annual income requirement for the card chosen.

How long does it take to get a Chase Business credit card?

Chase will review your application within 24 to 72 hours of receiving it. You will be notified of the decision by email or telephone. If approved, your card should arrive in 7-10 days.

How long should you wait before applying for another Chase Business credit card?

Chase suggests waiting at least three months before applying for a business credit card. This timeframe may vary based on your creditworthiness or previous applications. Check the rules of each card before applying.

Bottom Line

With the right information and preparation, applying for a Chase credit card for business can be an easy process. Gather the required documents, select the card that best suits your business, and review the application carefully before you submit it. Follow these steps, and consider the additional information that is provided. You’ll soon be on your way to getting a useful financial tool for your company.

Sign up now for the Chase Freedom Unlimited Card and receive unlimited cash back for one year. Cash-back rewards will be matched by the issuer for the first year of opening the account.