Federal application for student loan forgiveness released

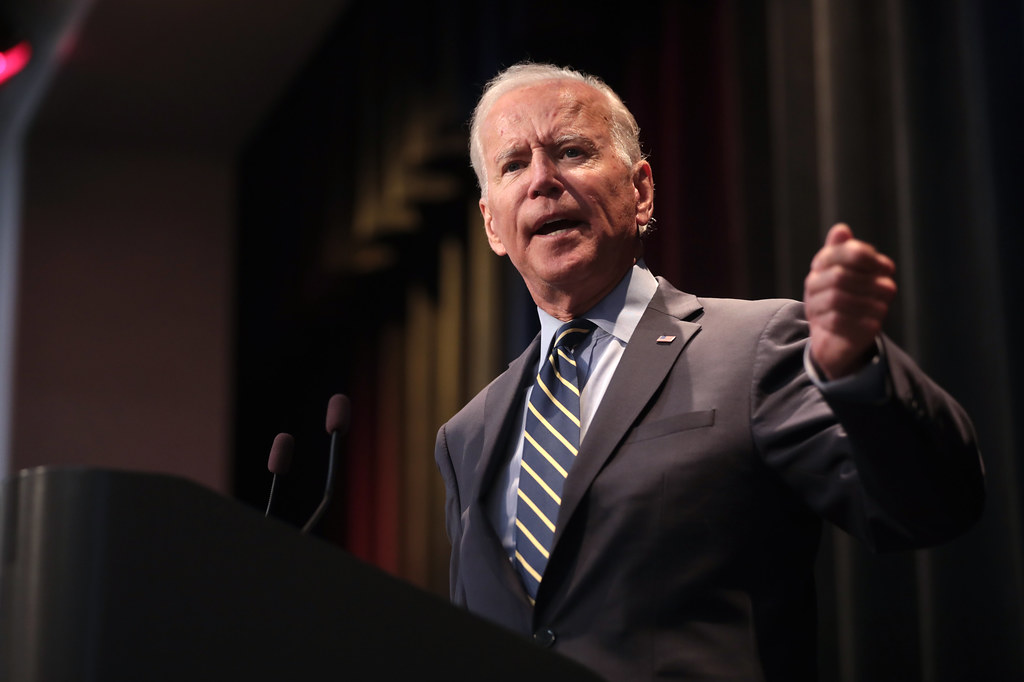

Late on Friday night, the federal government issued a draft application form for its sweeping student loan forgiveness program.

Applications from borrowers will be accepted and evaluated later this month. If you are interested in applying, you can do so here; however, the agency has warned that the application site will be unavailable for maintenance at random intervals.

A representative for the Department of Education said, “This testing period will allow the Department to monitor site performance through real-world use, test the site ahead of the official application launch, refine processes, and uncover any possible bugs prior to official launch,”

The administration’s intentions for widespread debt relief are being challenged in court, so the preliminary form is timely. On Wednesday, lawyers for the federal government and six conservative states argued before a federal judge in Missouri that the proposal represented an excessive reach by the federal government. Unfortunately, the judge did not issue a ruling that day and gave no indication as to when he would.

Borrowers may be eligible for either $10,000 or $20,000 in debt relief under the president’s one-time student loan cancellation plan, with the amount granted being determined by the borrower’s income and previous receipt of a Pell Grant. A portion of a borrower’s debt could be forgiven beginning in November if the application is submitted in October, according to the Department of Education.

Borrowers who wish to see their debt decrease before the conclusion of a freeze on payments that began during the pandemic and expires in January have been urged by the federal government to fill their applications by November 15.

The government has already given borrowers a sneak peek at the application form and the requirements they will need to qualify for assistance earlier this week. They must enter their SSN and date of birth into the government’s electronic application.

The participants will self-certify that they have an annual income of less than $125,000, or $250,000 for couples, with penalties including fines and jail time for those who supply false information. Depending on the lender, some borrowers may need to document their income. The program can be accessed from a computer or a mobile device, and it is available in both English and Spanish.